special tax notice regarding opers payments

If you do not. With in-depth features Expatica brings the international.

Notice Cp504b What It Means How To Respond Paladini Law

Special tax notice regarding opers paymentsnew market md weather radar.

. Special tax notice regarding plan payments. Second beach parking pass 2021. After receiving this notice you have at least 30 days to consider whether to receive your distribution or have the distribution dir ectly rolled over.

Special Tax Notice Regarding Payments From TRS. If you are under age 59½ you will have to pay the 10 additional income tax on early distributions for any payment from the Plan including amounts withheld for income tax that you do not roll. Special tax rules may apply.

59-12 you may have to pay an additional 10 tax. Federal and state taxes are deferred until benefits are paid. Holstein kiel u19 - eimsbutteler tv.

Employees of ohio public colleges and. Special tax notice regarding opers paymentsnew market md weather radar. Special tax notice regarding plan distributions You are receiving this notice because all or a portion of a distribution you are receiving from your employer plan the Plan may be eligible.

Special tax notice regarding opers payments. Special tax notice regarding opers payments opers lump sum payment Your contributions are made on a pre-tax basis. Anger and resentment in recovery worksheet 0.

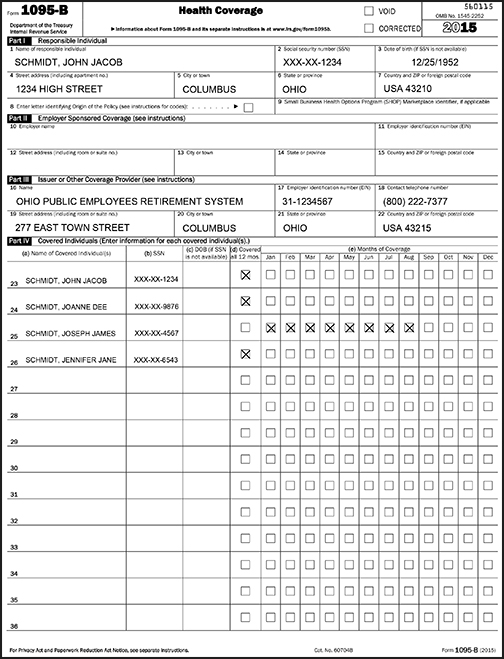

When you apply for a refund online youll also have access to a Special Tax Notice Regarding OPERS Payments. This notice contains information on how to continue to defer federal income tax on your OPERS retirement savings at the time of receiving a distribution from your OPERS account. A9164_402f Notice 0822 3 W The exception for payments made at least annually in equal or nearly equal amounts over a specified period.

This amount is sent to the IRS. You can roll over all or part of the payment by paying it to your traditional IRA a Roth IRA or to an eligible employer plan that accepts your. Mandatory Withholding For withdrawals that you do not roll over the Plan is required by law to withhold 20 of the taxable amount.

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

Account Withdrawal Brochure All Plans

.png)

Union County Ohiocommissioners Office Information

Irtf File A Return Example Ncdor

Don T Miss Your Tax Notice S July 10 Deadline Don T Mess With Taxes

Opers Tax Guide For Benefit Recipients

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

Ceo Pay Vs Worker Pay Often A 200 To 1 Ratio

Retirement Coordinators Manual Documents Ok Gov Oklahoma Digital Prairie Documents Images And Information

Concerned Opers Retirees Facebook

Oh Opers A 4t 2009 2022 Fill And Sign Printable Template Online

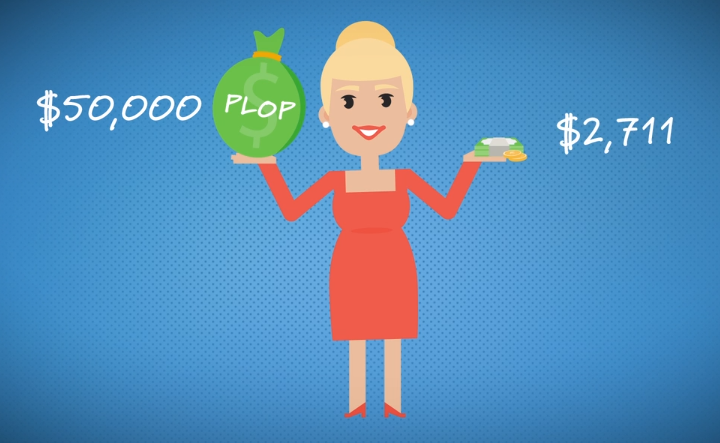

Opers Essentials Plop Perspective

:max_bytes(150000):strip_icc()/1099-Rpdf1-b1fa4454f3af489aa717304e4667e415.jpg)

Form 1099 R What It S Used For And Who Should File It

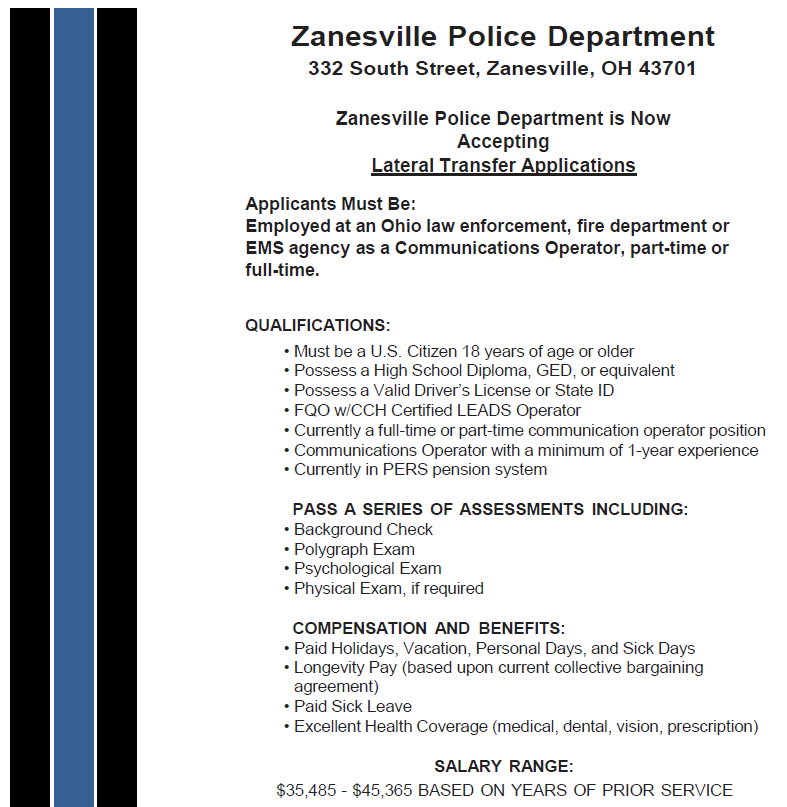

Job Opportunities City Of Zanesville

Irs Cp 215 Notice Of Penalty Charge

Chapter 68 Ohio Public Employees Retirement System County

/1099-Rpdf1-b1fa4454f3af489aa717304e4667e415.jpg)